At the Greennex Pulse November Roadshow, the conversation centered on a question that’s become increasingly urgent for climate tech startups: how do breakthrough technologies actually make it from university research labs to commercial deployment? With venture capital investor expectations resetting and federal funding becoming less certain, the pathway from research to revenue is being reimagined through new university-industry partnerships and commercialization strategies.

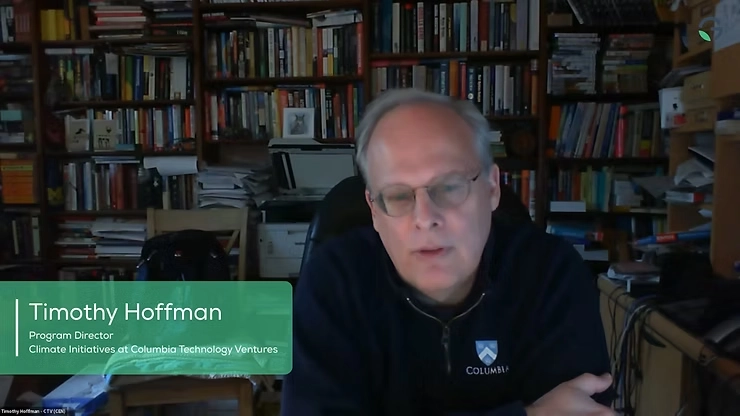

Timothy Hoffman speaking live at the Greennex Pulse November Roadshow

Timothy Hoffman, Program Director for Climate Initiatives at Columbia Technology Ventures, shared insights on how the climate tech investment landscape has evolved, which subsectors are attracting capital today, and why strategic acquisitions—not IPOs—remain the dominant exit path for deep tech climate startups. With nearly 20 years navigating investment banking and climate tech commercialization, Hoffman leads multiple NYSERDA-funded programs supporting early-stage startups across New York State, including the ClimateTech Expertise Network, which has tracked 13 exits to date.

In this conversation, he breaks down the shift from risk tolerance to “return to quality” in climate tech venture capital, why hardware technologies are struggling despite strong fundamentals, and how international acquirers from Europe and Asia are becoming critical exit partners for U.S. climate tech companies.

1|Columbia’s Positioning in Climate Tech Commercialization

Greennex Global: What is Columbia Technology Ventures’ strategic positioning in the climate tech space? How does Columbia differentiate itself from other top universities?

Timothy Hoffman: Columbia Technology Ventures operates as the technology transfer office for Columbia University, but what sets us apart is that our initiatives extend well beyond the university itself. We support startups across multiple sectors through programs like our Lab-to-Market accelerators, some of which work with companies that may have no affiliation with Columbia at all.

My role is particularly focused on climate-related initiatives funded by government agencies and corporations. Currently, I run two programs funded by NYSERDA, the New York State Energy Research and Development Authority, which is funded by ratepayers rather than taxpayers. I have colleagues who administer a more research-focused program funded by NYSERDA in the carbon capture and utilization space, called the Carbontech Development Initiative.

The flagship program is the Climate Tech Expertise Network, which supports climate tech startups with greenhouse gas reduction solutions in New York State, from company formation all the way through scaling—pre-seed to Series B. The support is comprehensive: one-on-one and group mentoring, skill-building workshops, talent matching, professional services funding, and quarterly investor connections.

We’re about to launch something new: an initiative that assesses startup readiness to engage with large corporations, utilities, and municipalities around pilots and demos. This program supports Columbia spinouts, but the majority are startups with no university connection. It’s really about fostering innovation across New York’s entire climate tech ecosystem, and we collaborate with every incubator and accelerator program throughout the state.

Greennex Global: What new types of startup-institution partnerships are you seeing emerge?

Timothy Hoffman: We’re seeing more hybrid “own-and-operate” models where startups build and run their first facilities before moving to licensing or joint ventures. It’s capital-intensive, but it gives founders control and credibility with investors and corporate partners.

We’re also facilitating more pilot and demo partnerships between startups and large corporations, utilities, and municipalities. These aren’t just proof-of-concept exercises; they’re field-testing that de-risks technologies in real-world applications. With certain federal non-dilutive funding becoming less certain, startups are leveraging state funding sources like NYSERDA to support these pilots when corporates don’t offer paid pilots.

2|The Shifting Investment Landscape for Climate Tech Startups

Greennex Global: You’ve been in climate tech for over two decades. How have investor expectations changed? What used to work five years ago that doesn’t work anymore?

Timothy Hoffman: The landscape has completely transformed. I’ve watched multiple investment waves over nearly 20 years, and even the language we use has evolved—from cleantech to impact investing to climate tech over the past 5-7 years. But it’s not just semantics. Sectors cycle in and out of favor, and the stage at which investors are willing to engage has shifted dramatically.

Up until this year, we were seeing larger funding rounds at every stage and much greater risk tolerance. Seed-stage companies could raise on less traction, and Series A expectations were more flexible. Investors were more open to taking early bets.

What we’re seeing now is what I’d call a return to quality and significantly reduced risk tolerance. Investors who previously funded at seed stage now expect Series A-level achievement before they’ll commit; validated market adoption, early traction, strong fundamentals. Plans are being scrutinized much more closely. The bar has risen across every stage.

There’s an ironic pattern I’ve noticed over time: investors say they don’t want to rely on regulatory support or government incentives. However, investment activity consistently increases during periods where there’s stronger policy support in various sectors. That dynamic is playing out again today; we’re seeing capital move away from sectors that were recently favored toward others that weren’t previously getting attention.

Greennex Global: Which climate tech subsectors are attracting venture capital right now, and which promising areas are struggling to get investor attention despite strong fundamentals?

Timothy Hoffman: The sectors having a harder time might surprise people. Carbon capture and utilization was very much in favor a few years ago, now it seems to be struggling. Technologies that require heavy infrastructure buildouts are finding it difficult. EV charging infrastructure is having a hard time raising capital. Even certain battery chemistries are struggling, despite the fact that batteries are absolutely essential to enable more renewables on the grid and solve data center power challenges.

Pretty much any hardware technology is facing headwinds, except for specific areas that are currently in strong favor.

What’s in the strong interest category right now: anything related to data center efficiency, including down to the chip level, as well as more efficient cooling technologies. Technologies and solutions that enable onshoring of production in the United States are finding more traction. Critical minerals, where we can mine sustainably and cost-effectively onshore, is receiving a lot of attention. Geothermal is another area favored by the current administration, and we’re starting to see more traction.

In the New York City area, due to Local Law 97 as a driver, building energy efficiency solutions have a lot of market potential and are therefore of stronger interest.

Greennex Global: Are infrastructure investors like utilities and corporate strategics filling the funding gap that VCs left? What do they want that’s different?

Timothy Hoffman: Strategic investors have always preferred more mature technologies that have been de-risked in the field, and I don’t see that changing. If anything, due to profit margin pressures, they’re even more cautious than before.

I don’t necessarily see them filling the early-stage gap that VCs left. With certain federal non-dilutive funding sources becoming less certain, startups are having to find alternative ways to de-risk their technologies. If strategics are filling any gap, it’s through pilots and demos, helping startups de-risk technologies in real-world applications, often leveraging state funding sources like NYSERDA when corporates don’t offer paid pilots.

The reality is that there’s a gap. It has become harder for startups to move as quickly as they once could. They need to be more thoughtful and focused on getting to market with a minimum viable product. One critical path is through sales, the sooner they can generate revenue, the stronger their investment case becomes, and the more they can self-fund continued technology development.

3|Cross-Border Investment and International Climate Tech Markets

Greennex Global: From your perspective, what do international investors look for differently compared to U.S. VCs when evaluating American climate tech companies?

Timothy Hoffman: International investors are fundamentally looking at how the technology can be adopted globally, especially in their home markets. What works in the United States often needs adaptation, and vice versa. They want to see that the technology can be tweaked to meet the demands of their specific market.

They’re evaluating regulatory fit, carbon pricing regimes, local permitting dynamics, and any redesign needed to meet foreign or international standards. They’re looking for enough demonstrated traction to justify participation in their markets.

What’s interesting is that some of our startups have actually found stronger traction and economic support in Europe than they could access here through non-dilutive sources. There’s an example in the battery manufacturing space where a company obtained roughly 20 million euros of support in Europe for early-stage manufacturing. This was before the recent administration change, but it demonstrates that these opportunities aren’t necessarily dependent on U.S. policy shifts.

Other companies have found that certain markets are easier to penetrate abroad than in the United States. These are fundamentally global problems these startups are solving, and international investors are looking for technologies that can work in their home markets; which they understand deeply, as well as scale globally.

4|Climate Tech Exit Strategies: M&A Dominates Over IPOs

Greennex Global: Where do you see exit opportunities heading in climate tech? Are strategic acquirers becoming more active, or is the IPO path becoming more realistic for certain subsectors?

Timothy Hoffman:

Traditionally, 80% of VC-backed companies exit through M&A, and in the climate technology space, where you often see a heavier concentration of hard tech startups, this number is probably higher. I don’t expect that to change in the near term or long term.

Most exits will continue to happen through strategic acquisitions, with larger corporations acquiring innovative technologies that strengthen their businesses. What we’re seeing now is significant interest from European companies engaging with U.S. startups, often with longer-term acquisition aspirations. We’re also seeing increasing activity from large Japanese and South Korean companies looking to U.S. climate tech startups to help them deploy technologies that can decarbonize their economies.

Mitsubishi Electric, for example, has acquired two startups that participated in our program, and we expect to see more of that activity. We’ve tracked 13 exits from startups that accessed the Climate Tech Expertise Network so far, and the vast majority occurred through M&A.

The reality is very few climate tech startups will reach the scale required for an IPO.

Final Word: Commercial Traction and Strategic Exits Define Climate Tech’s Next Phase

Climate tech is transitioning from early experimentation to commercial deployment, and investor expectations have fundamentally reset. Today’s funding environment favors strong fundamentals, early revenue generation, and proven market adoption over promising technology alone. The startups that demonstrate execution discipline, successfully navigate the pilot-to-commercial-scale pathway, and build meaningful corporate partnerships will attract the capital needed to grow and ultimately, the strategic acquirers that dominate climate tech exits.

With European and Asian corporations actively seeking U.S. climate technologies to support decarbonization goals, the opportunity for cross-border M&A continues to expand. Columbia’s ClimateTech Expertise Network has tracked 13 exits, with the vast majority occurring through strategic acquisition rather than IPO. The path forward requires clarity: get to market quickly, prove commercial traction, and build toward strategic acquisition rather than public markets.

For university-led deep tech climate ventures, the commercialization pathway now runs through hybrid “own-and-operate” models, state-funded pilot programs, and corporate partnerships that de-risk technologies in real-world applications, especially as federal non-dilutive funding becomes less predictable.

Greennex Global is a cross-border market intelligence and deal flow platform focused on climate infrastructure. Greennex Pulse is our monthly investor program spotlighting frontier-stage, globally ready climate tech startups based in the U.S.

If you’re a startup interested in pitching at Greennex Pulse, apply here. If you’re an investor looking to connect with Greennex startups, please contact us at info@greennexglobal.com.